Business vehicle depreciation calculator

The total section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or van you use in your business and. The car depreciation calculator will reflect the cars initial value in this case over 20500 if you enter the value into the 3 years box.

Depreciation Of Vehicles Atotaxrates Info

Vehicles under 30000 can fall into instant asset write-off territory while.

. The MACRS Depreciation Calculator uses the following basic formula. Depreciation limits on business vehicles. The standard mileage rate method or the actual expense method.

You can generally figure the amount of your deductible car expense by using one of two methods. Your total actual expenses were 5000. All you need to do is.

C is the original purchase price or basis of an asset. The limits of the depreciation deduction including section 179 expense deductions for luxury automobiles placed in service in 2021 for which bonus depreciation is. Car Depreciation Calculator This calculator calculates the cost of depreciation for your car.

SLD is easy to calculate because it simply. 3000 500 1500 5000 Your total mileage was 18000 and. Select the currency from the drop-down list optional Enter the.

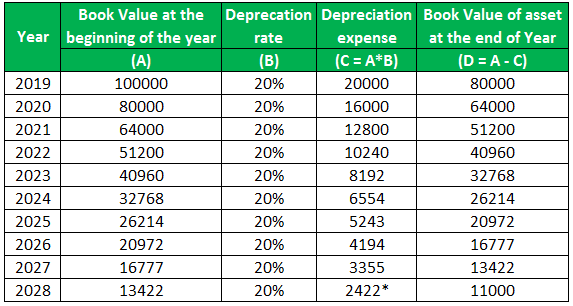

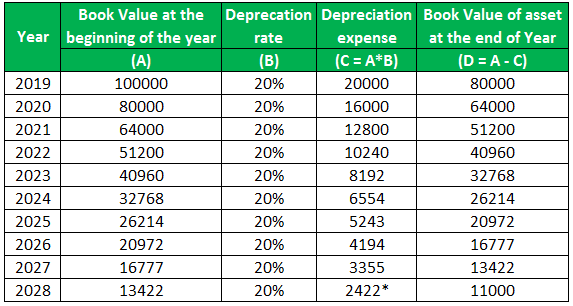

The calculator makes this calculation of course Asset Being. If you enter 100000 for basis and business use is 80 then the basis for depreciation adjusted basis is 80000. Heavy SUVs pickups and vans Much more favorable depreciation rules apply to heavy SUVs pickups and vans used over 50 for business because theyre treated as.

It is fairly simple to use. Input Is the car new or used. Where Di is the depreciation in year i.

If the business use on your vehicle is under 50 youre required to use the straight-line depreciation method SLD instead. The calculator also estimates the first year and the total vehicle depreciation. D i C R i.

What is the purchase price. How this rule applies to your business vehicles depreciation will depend on the cost of your vehicle. Alternatively if you use the actual cost method you may take deductions for.

Depreciation on the New Vehicle. To compute business vehicle. Tax provisions accelerate depreciation on qualifying business equipment office furniture technology software and other business items.

R10 99583 x 11 x 112 R10080. To use the calculator simply enter the purchase price of the car and the age at. The 2022 standard mileage rate is 585 cents per mile and for 2021 is 56 cents per mile for business.

Example Calculation Using the Section 179 Calculator Using a 75000 equipment cost for a sample calculation shows how taking advantage of the Section 179 Deduction can significantly. If its an old car there is no depreciation write-off. Use our car depreciation calculator to estimate how much your vehicle could decrease in value each year over the next six years.

Vehicle bought on 1 April 206 during the financial year therefore 1 month of depreciation.

Depreciation Of Car Word Problem Solution Youtube

.png)

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Depreciation Rate Formula Examples How To Calculate

Depreciation Calculator Depreciation Of An Asset Car Property

Using Spreadsheets For Finance How To Calculate Depreciation

Depreciation Schedule Template For Straight Line And Declining Balance

Annual Depreciation Of A New Car Find The Future Value Youtube

Macrs Depreciation Calculator Irs Publication 946

Depreciation Rate Formula Examples How To Calculate

Car Depreciation Calculator Calculate Straightline Reducing Balance Automobile Depreciation Rates Vehicle Values

Car Depreciation Calculator

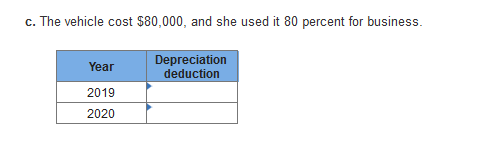

Solved Lina Purchased A New Car For Use In Her Business Chegg Com

Free Macrs Depreciation Calculator For Excel

Depreciation Of Vehicles Atotaxrates Info

Depreciation Formula Calculate Depreciation Expense

Depreciation Calculator

Depreciation Formula Calculate Depreciation Expense